The COVID-19 pandemic has uprooted our way of life, from the way we work to the way we socialize. Many of us began working from home, blending our personal and professional lives in ways we never expected. And while some of us have happily migrated back to the office as restrictions eased, others have embraced the opportunities that can come with remote work. This new way of life has also made many of us view our homes differently — recognizing a need for more space as we spend more time there — which in turn has had a major impact on the real estate market.

The shift to remote working has provided people the opportunity to migrate to less urban centres (secondary and tertiary markets) and enjoy a more affordable cost of living. This trend, more commonly known as ‘reverse urbanization,’ has changed what people look for in a home — more space, affordability — and has caught the attention of Avenue Living. Reverse urbanization is a trend that sees people place greater importance on their home space, often leaving inner-city locations to seek cheaper rents and larger living areas in secondary markets. Larger Canadian cities such as Vancouver, Toronto, and Montreal have seen thousands leave, experiencing record population losses.

Due to higher rents, living in Eastern Canadian cities and markets does not make economic sense for many. Avenue Living is seeing a trend where people are moving west to take advantage of the space the Prairie provinces offer as well as the increased affordability.

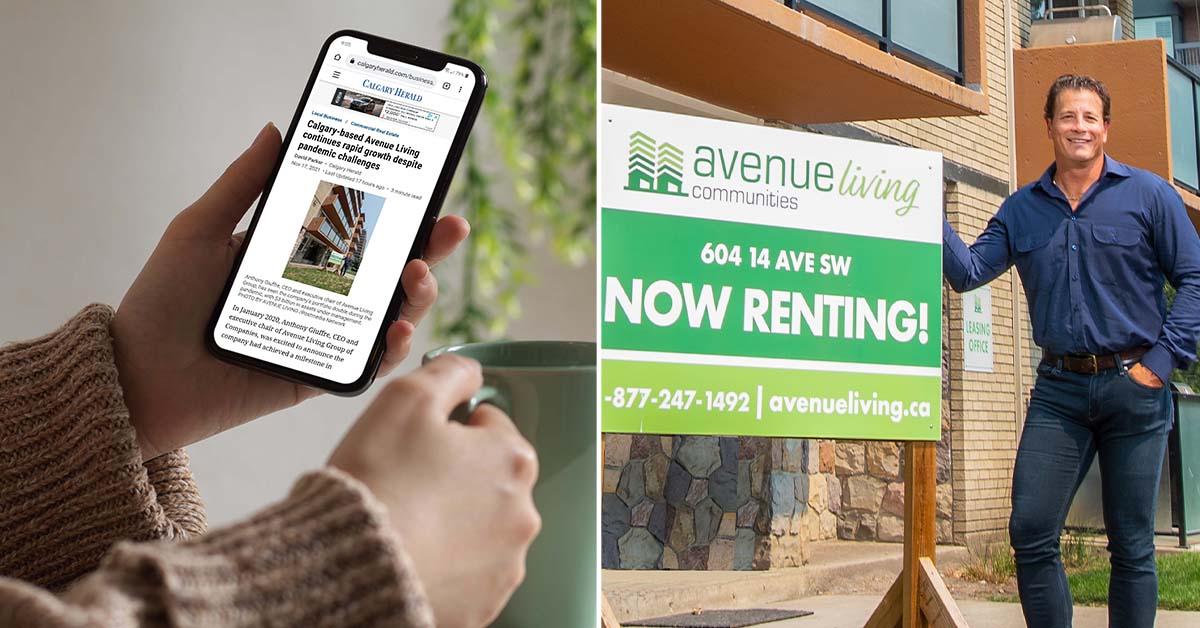

We are seeing population growth within our areas of focus — secondary and tertiary markets — and because we have been operating and performing in these markets for the past 15 years, Avenue Living is well situated to take advantage of this demographic shift.

People like flexibility, affordability, and space

Will people become full-time work-from-home employees? Will there be a balanced return-to-work program with some work from home sprinkled in? These factors ultimately play a part in where people decide to live, as does the affordability of smaller markets compared to larger centres.

Avenue Living aims to provide comfortable living spaces and affordability for our residents, and reverse urbanization has been beneficial for us. We have experienced strong occupancy from residents, with occupancy the highest it’s ever been, as our older assets tend to have larger floor plans than newer builds.

Avenue Living’s one-bedroom apartments are generally 600-650 sq. ft., whereas new builds are closer to 450 sq. ft., and our two-bedroom units can exceed 1,000 sq. ft.. The larger square footage offers greater potential for home-office setups, making our living spaces more desirable.

A trend within the real estate industry is to have buildings with lavish amenities, such as brand-new gyms and common areas. While those were formerly great selling points, they became obsolete when closed due to COVID-19, and people were confined to the smaller spaces in the new builds.

Renters are now placing a premium on more space over additional amenities.

Positive resident experience important for reverse urbanization

Now that they are home more, our residents expect a more complete experience from their property manager. They also expect open lines of communication and quick response times.

As active managers, we are proactive in finding out what our residents like and what they care about, and through prop-tech investments, we have helped drive efficiencies and streamline processes for us and our residents. We focus on operational efficiency, which helps drive retention, and optimizes length-of-stay for our residents, providing them with a better living experience.

Positive resident experiences are at the heart of Avenue Living’s operations as we work to consistently exceed expectations and create a sense of community and belonging. Gathering regular feedback from residents — at move-in, or after a maintenance request, for example — helps inform our practices and inspires us to continually improve.

For Avenue Living, reverse urbanization is a trend to watch closely. If it continues on its trajectory, we could continue seeing strong rent growth and demand for many of the regions we operate in with little competition, and our platform and business strategy has us well positioned to take further advantage of this trend.

This commentary and the information contained herein are for educational and informational purposes only and do not constitute an offer to sell, or a solicitation of an offer to buy any securities or related financial instruments. This article may contain forward-looking statements. Readers should refer to information contained on our website at www.alamstg.wpenginepowered.com for additional information regarding forward-looking statements and certain risks associated with them.