“The property management industry is resilient,” says Bernard Streeper, Senior Vice President (SVP), Northern Alberta for Avenue Living Communities.

While other industries ebb and flow with the economy, people will always need places to live, and in multi-family residential properties, there’s always a manager. But while the prospects for employment remain steady, the industry itself is undergoing a transformation. The property management industry has traditionally been a fragmented one, dominated by smaller operators who have largely learned “on the job,” as they tackle everything from viewings and lease management to maintenance and repairs.

Advances in prop-tech, more complex systems in buildings, and evolving resident expectations are all demanding a more standardized, professional approach to management.

“In the past, you might have one manager who’s looking after the entire building, and he goes to bed at eleven o’clock at night. You can see how that breaks down if someone has a problem at 11:30,” says Bernard.

High-tech equipment and prop-tech have made building systems more efficient, but also more complex. Property managers now need to develop the same knowledge facilities managers have been amassing for years. They may not have to be experts on sprinkler systems or boilers, for example, but they must understand the basics and how their function can affect resident satisfaction — and the health of the building.

On-the-Job or By-the-Books

In spite of how vital a service good property management is, the profession is still evolving in terms of certification and training. The Real Estate Institute of Canada (REIC) offers a Certified Property Manager (CPM) designation, an internationally recognized designation that “demonstrates a mastery of the analytical and leadership skills needed to enhance the short and long-term values of large real estate portfolios, including residential, commercial, condominium, industrial, institutional and mixed-use.” Our own Bernard Streeper holds this designation, having gone through the two-year program as a complement to his MBA and years of experience in the industry.

CPM designation is targeted at professionals with a variety of credentials — post-secondary education, other industry designations, or on-the-job experience. Required courses touch on everything from how best to manage a team to effective marketing and financial tools.

This designation is a way of bolstering credibility in the industry, much the way BOMA (Building Owners and Managers Association) and other organizations have done for commercial building operators and facility managers. In fact, there is a great deal of overlap now between property managers and facility managers, who both deal with complex structures and systems and are both navigating higher customer expectations.

While training and certification programs are currently few and far between, we have filled the gap by developing focused training modules, which we deliver through Avenue Living University. We’ve started using virtual reality (VR) technology to help our maintenance associates learn new skills, even from a distance (and with the physical distancing in place that’s so important right now). Ensuring our employees have proper training benefits our team as well as the residents and properties we serve.

Measuring the Outcome

“One of the things Avenue Living has done really well is figure out how we can quantify the resident experience,” says Bernard. In fact, it’s become something of a mantra at Avenue Living: David Porter, our SVP for Southern Alberta, often says, “What gets measured gets managed.”

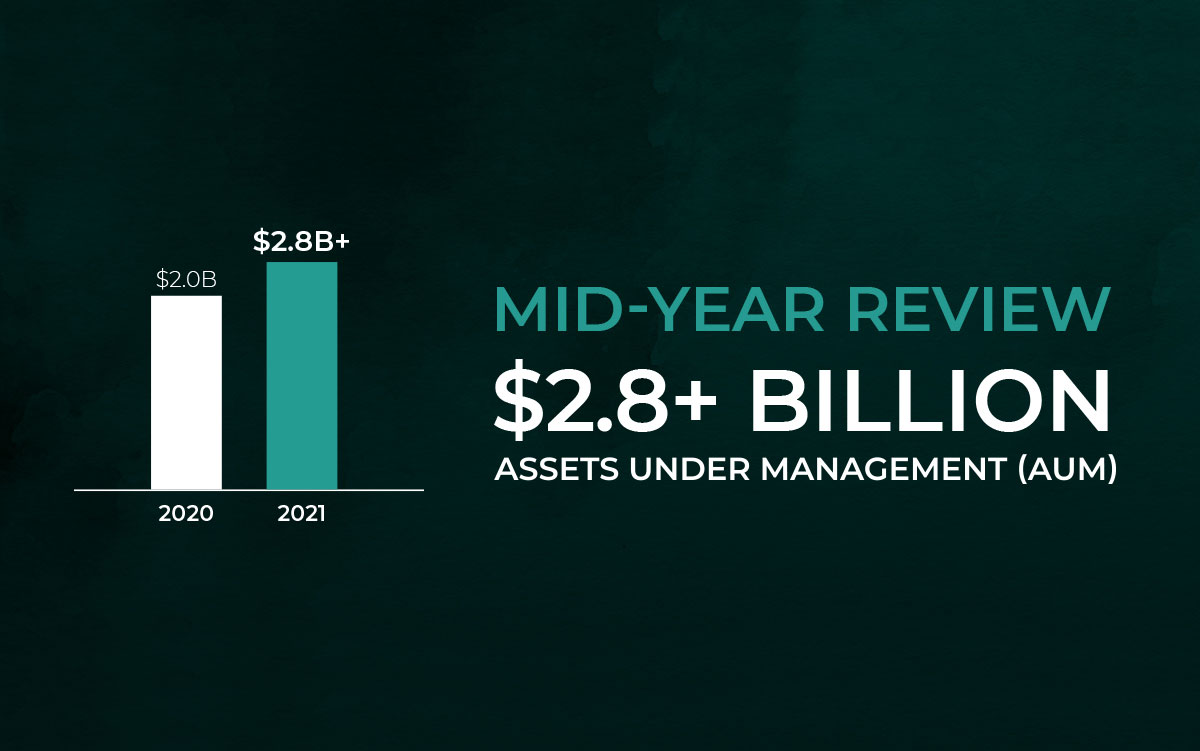

What gets measured also provides value for investors. The data we collect allows us to maximize our investment in our properties, but also allows us to set clear benchmarks and continually improve our processes. As we consolidate what has traditionally been a fragmented industry, we bring standardization and a proven customer-service model to our multi-family assets, ensuring we operate to an industry-leading standard.

Our Call Centre and work-order resolution processes aim to address resident issues and measure satisfaction through clear, ongoing communication. Connecting with our residents helps us see where we need to refine our processes or skills to ensure we meet expectations. Our three SVPs cover a lot of territory, and it’s vital their teams have the knowledge they need to keep operations at every property running smoothly.

“SVPs and regional vice presidents are not always on-site to deal with problems. We look at what we’re measuring, and gauge it against our experience, and if something jumps out at us —that’s when we get involved.” The goal is to equip our teams with everything they need to address issues quickly and efficiently. That could mean knowing when to call a trade — and who to call — or how to work with residents to address other concerns. It also involves a proactive approach to maintenance, including regular audits to ensure systems are in good repair.

The professionalism we foster through training and culture exists at every level of our organization and starts from the moment a prospective resident reaches out to us. And it’s professionalism that’s transforming and elevating the property management industry. “It really is an industry where you can build a career,” says Bernard.

This commentary and the information contained herein are for educational and informational purposes only and do not constitute an offer to sell, or a solicitation of an offer to buy any securities or related financial instruments. This article may contain forward-looking statements. Readers should refer to information contained on our website at www.alamstg.wpenginepowered.com for additional information regarding forward-looking statements and certain risks associated with them.