CALGARY, AB, Sept. 28, 2021 /CNW/ – Avenue Living Asset Management (Avenue Living) is pleased to announce it has surpassed $3 billion in assets under management (AUM), adding to its historic year of milestones through a series of strategic acquisitions.

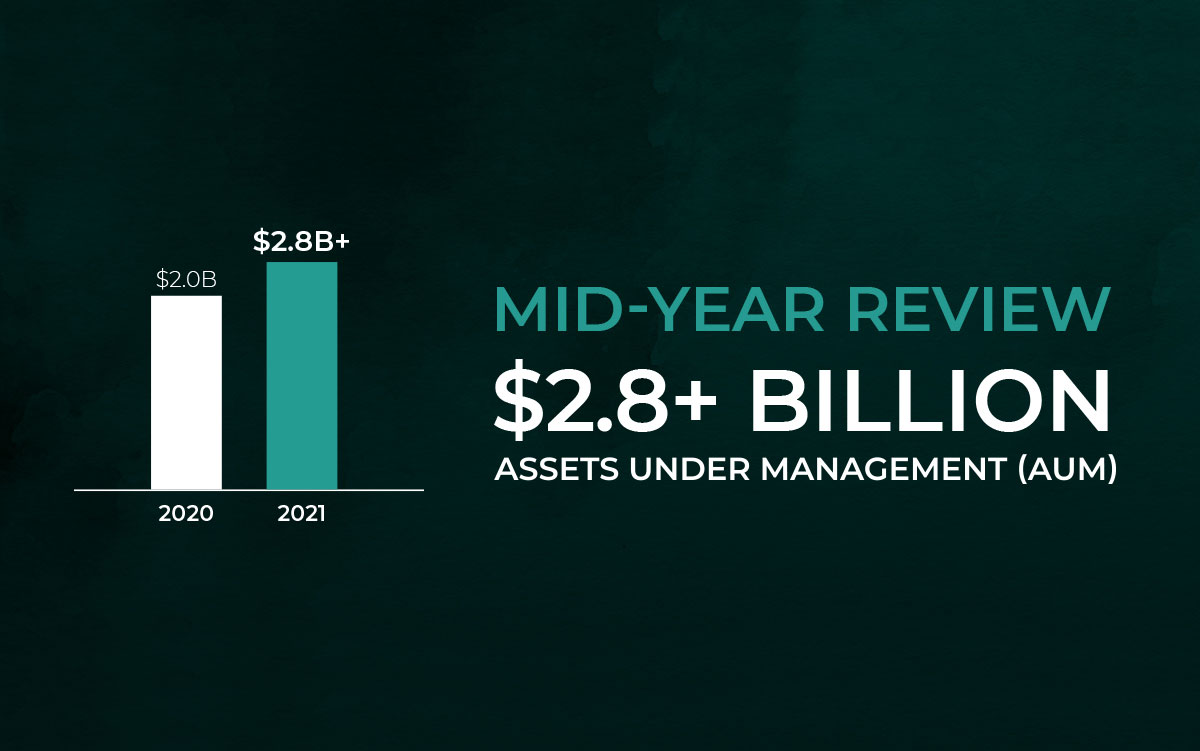

In the past year and a half, Avenue Living has added $1.5 billion in assets, more than doubling its portfolio during the global pandemic. Avenue Living has proven the resilience of its business model and vertically integrated platform of shared services, which supports the organization’s multi-family residential, commercial, agricultural, and self-storage interests.

“Recent multi-family acquisitions throughout Western Canada, coupled with our ongoing U.S. acquisitions on the multi-family side and the growth of our self-storage business have contributed to this significant $3 billion milestone,” said Anthony Giuffre, Founder, Chief Executive Officer and Executive Chairman, Avenue Living Group of Companies. “We carefully choose opportunities and build infrastructure that supports everything we do – we’re champions of the everyday. The strength of our platform lies in having sound mind and management — working with the right people, both in our own offices and other areas to help us serve our investors and communities, and to continue to deliver to the Avenue Living gold standard.”

Today’s renters expect property owners and managers to provide them with a responsive customer experience and to invest in maintenance and improvements, especially in aging buildings. Many smaller operators are not able to invest the capital required to maintain operations that meet those expectations. For Avenue Living, these properties present an opportunity to consolidate fragmented industries and, through active management as well as strategic capital expenditures, provide a best-in-class experience for tenants and drive value for investors.

Avenue Living’s flagship trust, the Avenue Living Real Estate Core Trust — which acquires quality multi-family assets — is in a good place to meet the growing demand for housing affordability. Since its inception in 2006, the company has stayed true to its unique selling proposition of offering safe, quality, comfortable, and affordable rental spaces, with intentional emphasis placed on creating a positive resident experience.

“The greatest indicator of success is customer retention, and at Avenue Living, we ensure this through maintaining high customer service standards,” said Giuffre. “Historically, there’s been a certain predictability to the asset classes we invest in, and that’s what investors are looking for.”

Avenue Living takes a holistic, customer-centric approach when it comes to all aspects of its operations — from collections to leases, renewals, maintenance, capital expenditures, and expense management. The company starts with its customers’ needs and maps out the entire customer journey, from brand awareness through to advocacy. The organization has also leaned on property technology, or “prop-tech,” such as electronic leasing, to simplify basic processes for its residents and tenants, which has further enabled the efficient delivery of its value proposition.

In doing this, Avenue Living offers value to its customers — whether these customers are residents of their multi-family properties or tenants of their commercial, agricultural land or self-storage offerings.

“The pandemic truly tested the resilience of our investment thesis. Our choice of investing in ‘the everyday’ coupled with the tenacity of our customer and employee base has allowed us to achieve this milestone,” said Giuffre. “As we look ahead at the remainder of 2021 and beyond, we see a significant opportunity for the Avenue Living Group of Companies to continue to fire on all cylinders.”

About Avenue Living Asset Management:

Avenue Living Asset Management is a leading Canadian alternative asset manager with over $3 billion in assets under management and five alternative investment products. Avenue Living has amassed over 12,000 doors in Canada, making it one of Canada’s largest multi-family residential providers by serving more than 25,000 Canadians across 17 markets. Its U.S. multi-family fund exceeds $100 million in AUM and its self-storage fund has more than $300 million in AUM. Avenue Living’s agriculture fund has expanded its acres under management to more than 48,000, raising its AUM to more than $90 million.