2006*

Inception date

*Through predecessor entities

Core Trust was formed in 2017

Multi-family

Mutual fund trust

For over 17 years, we have built a unique operating platform with a specialized team and a defensible strategy. With our first property in Brooks, Alberta, we embarked on a journey to consolidate multi-family residential assets in secondary and tertiary markets that most investors overlooked.

For over 17 years, we have built a unique operating platform with a specialized team and a defensible strategy. With our first property in Brooks, Alberta, we embarked on a journey to consolidate multi-family residential assets in secondary and tertiary markets that most investors overlooked. We saw the need to build a proprietary platform that could deliver an exceptional resident experience while meeting the demands of our growing business. With a vertically integrated platform designed to acquire, optimize, and manage low-density real estate assets across moderate-growth markets, we have one of the most differentiated business models in our industry today.

Until 3 years ago, our portfolio was concentrated in the Canadian Prairies. We are now replicating our strategy across 7 provinces and 15 states — over one-third of Canada and the United States. During this period of expansion, we successfully navigated volatile market conditions, bolstered our platform, and fostered relationships with new and existing capital stakeholders to arrive at our most successful year in Avenue Living’s history.

2022 was a pivotal year in our business in many ways. With record-breaking returns, our total assets under management (AUM) grew from $3.1 billion to $4.6 billion — an increase of 48%. Our Core Trust AUM grew by nearly a third, Mini Mall Storage Properties more than doubled its portfolio growing to over $1 billion AUM, and our Agricultural Land Trust added 35,000 acres to increase its AUM by 88%. We opened new offices in Toronto and Dallas and expanded our Montreal presence to strengthen connections with investors and the financial community across North America. We continued to build on our diverse team and now have employees living in 8 provinces and 19 states. The success we are experiencing today has been forged through years of dedication to our strategy coupled with steadfast stakeholder support.

Our investments in real estate impact people’s day-to-day lives, which is why we actively evaluate the communities we operate in and find ways to help them thrive. We continued to invest in farmland, helping farmers meet the growing global food demand. We also began a landmark partnership with the Canada Infrastructure Bank to implement deep energy retrofits at 6,700 multi-family units across Western Canada, targeting a 49% reduction in GHG emissions and positively impacting 10,000 residents. This partnership follows the pledge we made as signatories of the United Nations-supported Principles for Responsible Investment and marks an exciting way for us to lead the multi-family property industry and take real climate action for all Canadian renters.

Looking ahead to 2023, we see a year full of promise and rewards. No matter how the market shifts, we will continue to stay the course — with the help of an experienced, insightful team and a proven platform that allows us to keep driving value for our customers, investors, and employees.

Sincerely,

We saw the need to build a proprietary platform that could deliver an exceptional resident experience while meeting the demands of our growing business. With a vertically integrated platform designed to acquire, optimize, and manage low-density real estate assets across moderate-growth markets, we have one of the most differentiated business models in our industry today.

Until 3 years ago, our portfolio was concentrated in the Canadian Prairies. We are now replicating our strategy across 7 provinces and 15 states — over one-third of Canada and the United States. During this period of expansion, we successfully navigated volatile market conditions, bolstered our platform, and fostered relationships with new and existing capital stakeholders to arrive at our most successful year in Avenue Living’s history.

2022 was a pivotal year in our business in many ways. With record-breaking returns, our total assets under management (AUM) grew from $3.1 billion to $4.6 billion — an increase of 48%. Our Core Trust AUM grew by nearly a third, Mini Mall Storage Properties more than doubled its portfolio growing to over $1 billion AUM, and our Agricultural Land Trust added 35,000 acres to increase its AUM by 88%. We opened new offices in Toronto and Dallas and expanded our Montreal presence to strengthen connections with investors and the financial community across North America. We continued to build on our diverse team and now have employees living in 8 provinces and 19 states. The success we are experiencing today has been forged through years of dedication to our strategy coupled with steadfast stakeholder support.

Our investments in real estate impact people’s day-to-day lives, which is why we actively evaluate the communities we operate in and find ways to help them thrive. We continued to invest in farmland, helping farmers meet the growing global food demand. We also began a landmark partnership with the Canada Infrastructure Bank to implement deep energy retrofits at 6,700 multi-family units across Western Canada, targeting a 49% reduction in GHG emissions and positively impacting 10,000 residents. This partnership follows the pledge we made as signatories of the United Nations-supported Principles for Responsible Investment and marks an exciting way for us to lead the multi-family property industry and take real climate action for all Canadian renters.

Looking ahead to 2023, we see a year full of promise and rewards. No matter how the market shifts, we will continue to stay the course — with the help of an experienced, insightful team and a proven platform that allows us to keep driving value for our customers, investors, and employees.

Sincerely,

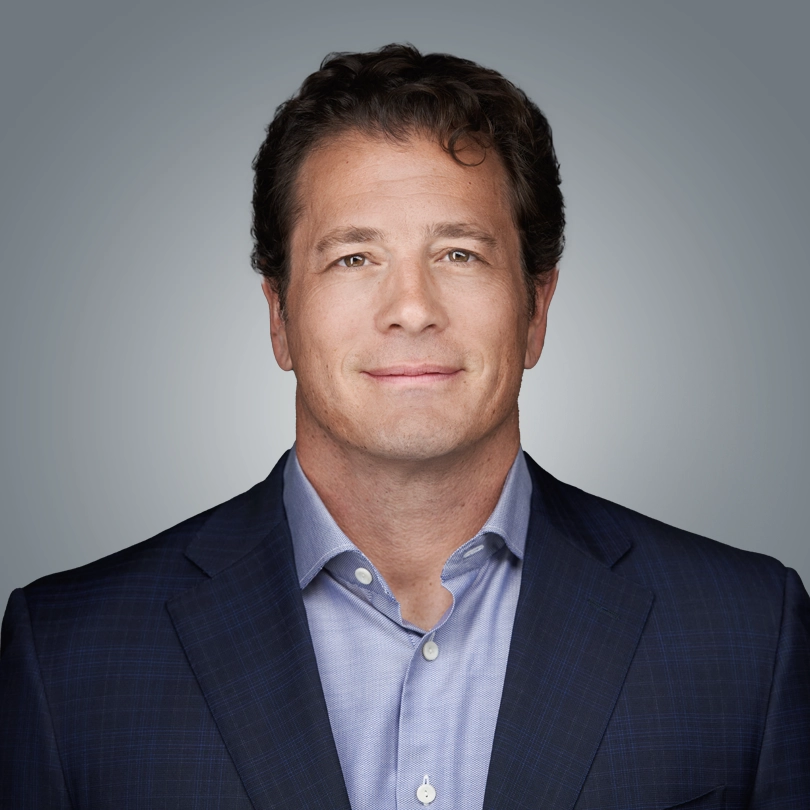

FOUNDER, CHIEF EXECUTIVE OFFICER & EXECUTIVE CHAIRMAN, AVENUE LIVING

FOUNDER, CHIEF EXECUTIVE OFFICER & EXECUTIVE CHAIRMAN, AVENUE LIVING

Avenue Living is a vertically integrated real-estate owner and operator with over $4.6 billion in assets under management (AUM). Established in 2006, we acquire, reposition, and manage real estate across Canada and the United States using 4 investment vehicles. Centred around the ethos of “Investing in the Everyday,” we actively manage B and C-class multi-family residential, self-storage, farmland, and commercial assets. We consider ourselves stewards of capital — our goal is to create long-term value and drive returns through our proven investment strategy.

*Through predecessor entities

Core Trust was formed in 2017

Avenue Living is a vertically integrated real-estate owner and operator with over $4.6 billion in assets under management (AUM). Established in 2006, we acquire, reposition, and manage real estate across Canada and the United States using 4 investment vehicles. Centred around the ethos of “Investing in the Everyday,” we actively manage B and C-class multi-family residential, self-storage, farmland, and commercial assets. We consider ourselves stewards of capital — our goal is to create long-term value and drive returns through our proven investment strategy.

*Through predecessor entities

Core Trust was formed in 2017

We look to them every time we make decisions — big or small, for our team members, customers, residents, or investors, for the immediate future or the long term.

We go the extra mile for our customers, investors, and employees.

We own it, we adapt in the face of challenges, and we relentlessly pursue progress.

We act with integrity, and we always work to do the right thing.

We’re transparent in how we communicate and act.

We stand together and work together to get things done.

We go the extra mile for our customers, investors, and employees.

We own it, we adapt in the face of challenges, and we relentlessly pursue progress.

We act with integrity, and we always work to do the right thing.

We’re transparent in how we communicate and act.

We stand together and work together to get things done.

These 4 fundamental tenets of our business model have served us well since our first acquisition in 2006 — and 2022 presented a unique set of challenges and opportunities that proved their validity once again. Our strategy allows us to deliver superior customer service to our residents while manufacturing alpha for our investors, guiding us as we’ve grown and evolved, shaping the creation of a platform that supports our initiatives, and allowing us to thrive even in times of economic downturn.

In 2022, we continued to dedicate time and resources to researching the forces impacting the real estate industry. This work allows us to optimize our operations and make informed decisions that benefit all our stakeholders.

We have a stable business model that withstands market fluctuations. Our proven investment philosophy has generated value throughout varied market conditions. We’ve grown in a way that’s strategic and sustainable, reducing risk by building a portfolio that spans several asset classes in markets that exhibit strong economic bases and by raising capital via a wide variety of networks.

We’re committed to ensuring our multi-family assets remain affordable for our target demographic. At a time when housing affordability is front-of-mind, we invest in an asset class that helps meet that growing need for safe, clean, and affordable housing. That means careful planning, strategic improvements, and continuous innovation in our customer experience.

We’re intentional in how we make acquisitions and capital improvements, choosing the path that makes the most sense for us, our stakeholders, and the communities in which we operate. This intention also drives our commitment to ESG initiatives that improve the comfort of our properties and reduce our carbon footprint.

Our customers are at the core of everything we do, and our commitment to ensuring our properties are actively managed to exacting standards sets us apart from other asset managers. We understand the needs and wants of our residents and tenants, and our vertically integrated platform allows us end-to-end control over operations, ensuring we provide top-tier customer service and drive value for our investors.

These 4 fundamental tenets of our business model have served us well since our first acquisition in 2006 — and 2022 presented a unique set of challenges and opportunities that proved their validity once again. Our strategy allows us to deliver superior customer service to our residents while manufacturing alpha for our investors, guiding us as we’ve grown and evolved, shaping the creation of a platform that supports our initiatives, and allowing us to thrive even in times of economic downturn.

In 2022, we continued to dedicate time and resources to researching the forces impacting the real estate industry. This work allows us to optimize our operations and make informed decisions that benefit all our stakeholders.

We have a stable business model that withstands market fluctuations. Our proven investment philosophy has generated value throughout varied market conditions. We’ve grown in a way that’s strategic and sustainable, reducing risk by building a portfolio that spans several asset classes in markets that exhibit strong economic bases and by raising capital via a wide variety of networks.

We’re committed to ensuring our multi-family assets remain affordable for our target demographic. At a time when housing affordability is front-of-mind, we invest in an asset class that helps meet that growing need for safe, clean, and affordable housing. That means careful planning, strategic improvements, and continuous innovation in our customer experience.

We’re intentional in how we make acquisitions and capital improvements, choosing the path that makes the most sense for us, our stakeholders, and the communities in which we operate. This intention also drives our commitment to ESG initiatives that improve the comfort of our properties and reduce our carbon footprint.

Our customers are at the core of everything we do, and our commitment to ensuring our properties are actively managed to exacting standards sets us apart from other asset managers. We understand the needs and wants of our residents and tenants, and our vertically integrated platform allows us end-to-end control over operations, ensuring we provide top-tier customer service and drive value for our investors.

We have a stable business model that withstands market fluctuations. Our proven investment philosophy has generated value throughout varied market conditions. We’ve grown in a way that’s strategic and sustainable, reducing risk by building a portfolio that spans several asset classes in markets that exhibit strong economic bases and by raising capital via a wide variety of networks.

We’re committed to ensuring our multi-family assets remain affordable for our target demographic. At a time when housing affordability is front-of-mind, we invest in an asset class that helps meet that growing need for safe, clean, and affordable housing. That means careful planning, strategic improvements, and continuous innovation in our customer experience.

We’re intentional in how we make acquisitions and capital improvements, choosing the path that makes the most sense for us, our stakeholders, and the communities in which we operate. This intention also drives our commitment to ESG initiatives that improve the comfort of our properties and reduce our carbon footprint.

Our customers are at the core of everything we do, and our commitment to ensuring our properties are actively managed to exacting standards sets us apart from other asset managers. We understand the needs and wants of our residents and tenants, and our vertically integrated platform allows us end-to-end control over operations, ensuring we provide top-tier customer service and drive value for our investors.

In June 2022, Avenue Living announced a landmark partnership with the Canada Infrastructure Bank (CIB) which will see a combined $150 million invested in sustainable retrofit projects in low-density residential buildings across Western Canada. This partnership reflects Avenue Living’s commitment to reduce greenhouse gas emissions while collectively addressing the Prairie region’s aging housing supply – improving the living conditions for thousands of Canadians. With the partnership underway, we’ve completed over 30 energy audits on our buildings and are looking forward to commencing work in the first half of 2023

Throughout 2022, we further enhanced our sustainability program across the business – a push we will continue in 2023 and beyond.

Work involving installing high-efficiency windows, replacing aging boilers, improving on-site waste management, even installing solar panels on self-storage facilities, helps us to reduce our carbon footprint and increase efficient energy usage for residents.

Grants and rebates provide Avenue Living an opportunity to conduct necessary and energy-saving improvements to our properties while providing efficient, quality, and affordable homes and services to our core customers. In 2022, such sources of funding included:

This year, Avenue Living sat down with a few industry-leading partners to discuss how sustainable environmental practices combined with exceptional resident experiences can lead to positive results for all.

As part of our partnership with the CIB, Avenue Living will conduct improvements to 220 multi-family residential buildings across 132 properties throughout the Canadian prairies. This means 6,700 individual homes being touched.

Learn More

Carefully considering the impact we make on the people and communities we serve is part of our DNA. As evidenced by our signatory commitment to the UN-supported Principles for Responsible Investment (PRI) and our ongoing retrofit work, Avenue Living is focused on enhancing the quality and sustainability of existing, affordable rental housing in North America.

We believe we have a role to play in the ongoing journey toward reconciliation with the Indigenous peoples of Canada. Our Truth and Reconciliation Speaker Series, creative partnerships with Indigenous community members, and multi-year commitment to help fund education opportunities through Indspire are some of the ways we turned our thoughts into actions last year.

In 2022, Avenue crafted an employee retirement savings program, now live across Canada and continuing to be implemented in the United States. This employer-sponsored plan offers employer-matching of eligible employees’ RRSP contributions.

Avenue Living is committed to operating with integrity, honesty, and transparency. We have implemented policies and procedures to minimize risk and to manage conflicts should they arise. As stewards of capital and conscientious owner-operators, it is incumbent on us to apply best-in-class governance methods across our business, and align those with the best interests of our investors.

Avenue Living adheres to a regular schedule of communication with investors.

Policies adopted by our Boards of Trustees are evaluated and updated as necessary to ensure regulatory compliance. They Include:

In June 2022, Avenue Living announced a landmark partnership with the Canada Infrastructure Bank (CIB) which will see a combined $150 million invested in sustainable retrofit projects in low-density residential buildings across Western Canada. This partnership reflects Avenue Living’s commitment to reduce greenhouse gas emissions while collectively addressing the Prairie region’s aging housing supply – improving the living conditions for thousands of Canadians. With the partnership underway, we’ve completed over 30 energy audits on our buildings and are looking forward to commencing work in the first half of 2023

Throughout 2022, we further enhanced our sustainability program across the business – a push we will continue in 2023 and beyond.

Work involving installing high-efficiency windows, replacing aging boilers, improving on-site waste management, even installing solar panels on self-storage facilities, helps us to reduce our carbon footprint and increase efficient energy usage for residents.

Grants and rebates provide Avenue Living an opportunity to conduct necessary and energy-saving improvements to our properties while providing efficient, quality, and affordable homes and services to our core customers. In 2022, such sources of funding included:

Carefully considering the impact we make on the people and communities we serve is part of our DNA. As evidenced by our signatory commitment to the UN-supported Principles for Responsible Investment (PRI) and our ongoing retrofit work, Avenue Living is focused on enhancing the quality and sustainability of existing, affordable rental housing in North America.

We believe we have a role to play in the ongoing journey toward reconciliation with the Indigenous peoples of Canada. Our Truth and Reconciliation Speaker Series, creative partnerships with Indigenous community members, and multi-year commitment to help fund education opportunities through Indspire are some of the ways we turned our thoughts into actions last year.

In 2022, Avenue crafted an employee retirement savings program, now live across Canada and continuing to be implemented in the United States. This employer-sponsored plan offers employer-matching of eligible employees’ RRSP contributions.

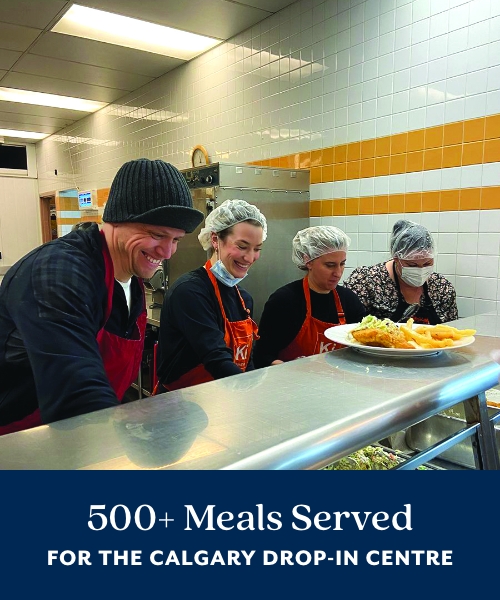

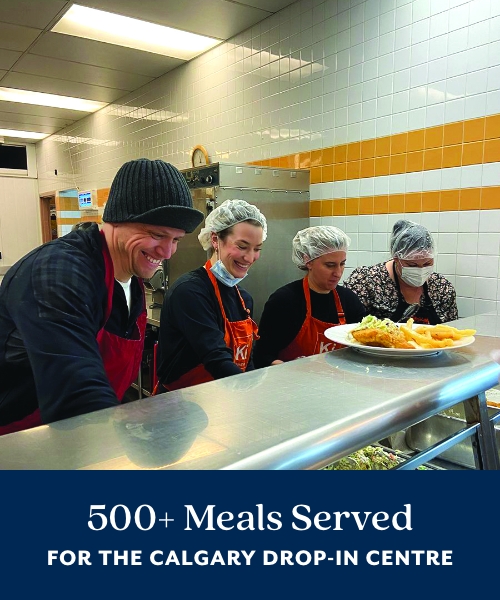

Our investment extends beyond hard assets and to the communities we operate in. Thanks to the efforts of team members throughout our organization, and some truly remarkable community partnerships, Avenue Living has had the honour of contributing to many important community-based causes throughout the year.

Avenue Living Communities, Avenue Living Asset Management, and Mini Mall Storage Properties teams were busy investing in the communities we serve throughout the year.

Avenue Living is committed to operating with integrity, honesty, and transparency. We have implemented policies and procedures to minimize risk and to manage conflicts should they arise. As stewards of capital and conscientious owner-operators, it is incumbent on us to apply best-in-class governance methods across our business, and align those with the best interests of our investors.

Avenue Living adheres to a regular schedule of communication with investors.

Policies adopted by our Boards of Trustees are evaluated and updated as necessary to ensure regulatory compliance. They Include:

Hover or tab over a state or province to see the number of properties managed by Avenue Living

This report has been prepared for informational purposes only. It does not constitute an offer to sell or a solicitation to buy any securities in any jurisdiction and it does not, and is not intended to, provide any financial, legal, accounting, or tax advice or counsel and must not be relied upon in that regard. This report is not to be distributed, reproduced, or communicated to any third party without the express written consent of Avenue Living Asset Management Ltd.

Certain information set forth in this report may contain “forward-looking information” under applicable securities legislation. Such forward-looking statements may include, without limitation: expansion plans for the Avenue Living Group and its business and projects; execution of the Avenue Living Group’s vision and growth strategy; and sources and availability of third-party financing for the Avenue Living Group’s projects. Forward-looking statements are based on a number of assumptions, including without limitation: expectations about general economic conditions and conditions in the real estate markets where the projects are located or where the Avenue Living Group operates; expectations about the ability to raise sufficient funds to complete business objectives; and expectations about the Avenue Living Group’s ability to continue to execute on its business plans. Although forward-looking statements contained in this report are based upon what management believes are reasonable assumptions, there can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Management undertakes no obligation to update any such forward-looking statements if circumstances or management’s estimates or opinions should change, except as may be required by applicable securities laws. The reader is cautioned not to place undue reliance on forward-looking statements. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance or any other factor mentioned in this report.

Avenue Living Asset Management Ltd. accepts no liability for any loss arising from the use of the information contained herein. Information, opinions or statistical data contained herein was obtained or derived from sources believed to be reliable, including from third-party sources, but Avenue Living Asset Management Ltd. does not represent that any such information, opinion, or statistical data is accurate or complete, and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgements as of the date of this report and are subject to change without notice. Avenue Living Asset Management Ltd. may have prepared certain information internally using proprietary analysis (unaudited).

The properties discussed in this report are not indicative of the full portfolio of properties held by the Avenue Living Group and there is no guarantee that future acquisitions will be comparable to the properties presented or will have similar results.

This report has been prepared for informational purposes only. It does not constitute an offer to sell or a solicitation to buy any securities in any jurisdiction and it does not, and is not intended to, provide any financial, legal, accounting, or tax advice or counsel and must not be relied upon in that regard. This report is not to be distributed, reproduced, or communicated to any third party without the express written consent of Avenue Living Asset Management Ltd.

Certain information set forth in this report may contain “forward-looking information” under applicable securities legislation. Such forward-looking statements may include, without limitation: expansion plans for the Avenue Living Group and its business and projects; execution of the Avenue Living Group’s vision and growth strategy; and sources and availability of third-party financing for the Avenue Living Group’s projects. Forward-looking statements are based on a number of assumptions, including without limitation: expectations about general economic conditions and conditions in the real estate markets where the projects are located or where the Avenue Living Group operates; expectations about the ability to raise sufficient funds to complete business objectives; and expectations about the Avenue Living Group’s ability to continue to execute on its business plans. Although forward-looking statements contained in this report are based upon what management believes are reasonable assumptions, there can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Management undertakes no obligation to update any such forward-looking statements if circumstances or management’s estimates or opinions should change, except as may be required by applicable securities laws. The reader is cautioned not to place undue reliance on forward-looking statements. Past performance is not a guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance or any other factor mentioned in this report.

Avenue Living Asset Management Ltd. accepts no liability for any loss arising from the use of the information contained herein. Information, opinions or statistical data contained herein was obtained or derived from sources believed to be reliable, including from third-party sources, but Avenue Living Asset Management Ltd. does not represent that any such information, opinion, or statistical data is accurate or complete, and they should not be relied upon as such. All estimates and opinions expressed herein constitute judgements as of the date of this report and are subject to change without notice. Avenue Living Asset Management Ltd. may have prepared certain information internally using proprietary analysis (unaudited).

The properties discussed in this report are not indicative of the full portfolio of properties held by the Avenue Living Group and there is no guarantee that future acquisitions will be comparable to the properties presented or will have similar results.